VA Mortgage Rates today are ideal for you looking for the best mortgage loans through Just funded mortgage.

If you|In the Event You} apply Today for your VA Mortgage Rates Today, together with Only financed mortgage, you could possibly well be able to prevent additional costs in the rate by which you close this loan.

The borrower is Obligated to pay for prepaid interest, condition mortgage taxes, real estate taxation, all types of insurance plan, current lender payment charges, review costs, and also discount point.

But if the Borrower such as you decides to pay discount points to lower the interest of his loan, even minimum amount of claimed loan could be 300,000, each of the Current VA Mortgage Rates, are imposed under compliance with the federal housing regulation of 1988.

On the List of Regulations on which this organization is predicated to grant the distinct mortgage obligations, they’ve been defined by the Federal Fair Housing Act, which specifies it is unlawful to discriminate against any consumer for the race, color, faith, disability, sex, or loved ones along with national source.

Anyone has got the Directly to make an application to your mortgage loan. Stillnot most of them is likely to be chosen, which means that you should apply as rapidly as possible and choose one of the people who’ll gain in your best Va Loan Rates, that promotes this particular company every 30 days by its site.

Any Customer might Input the purchase or rental of domiciles, advertising income or leases of homes, financing of housing, valuation of home and also the supply of genuine estate brokerage services, when you’ve felt that isn’t contained for any discrimination, file your criticism instantly on this site.

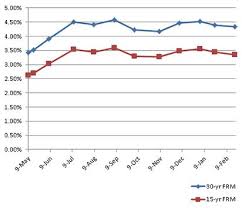

Currently, inside the Software and acceptance of the mortgage requested from you, you must be attentive to the VA Mortgage Rates today, as according on the collapse or increase, the last closure with this loan may experience a exact abrupt shift. Do not wait no more and see this website to get extra info.